Most business owners I meet live in a fantasy world. They think the day they decide to quit, a magical buyer will show up with a briefcase full of cash. They picture a handshake, a fat check, and a one-way ticket to a beach with unpronounceable cocktails.

Here is the reality.

Most small businesses never sell. They just fade away. They close the doors. And they liquidate assets for pennies on the dollar.

I sat across from a guy last month who had run a fabrication shop for thirty years. He was tired. His back was shot. He wanted out. When I asked what his exit strategy was, he shrugged and said he’d “put it on the market next year.” He thought his business was his pension. He was wrong. Without him there to yell at the suppliers and charm the clients, the business was worth the scrap value of his machinery.

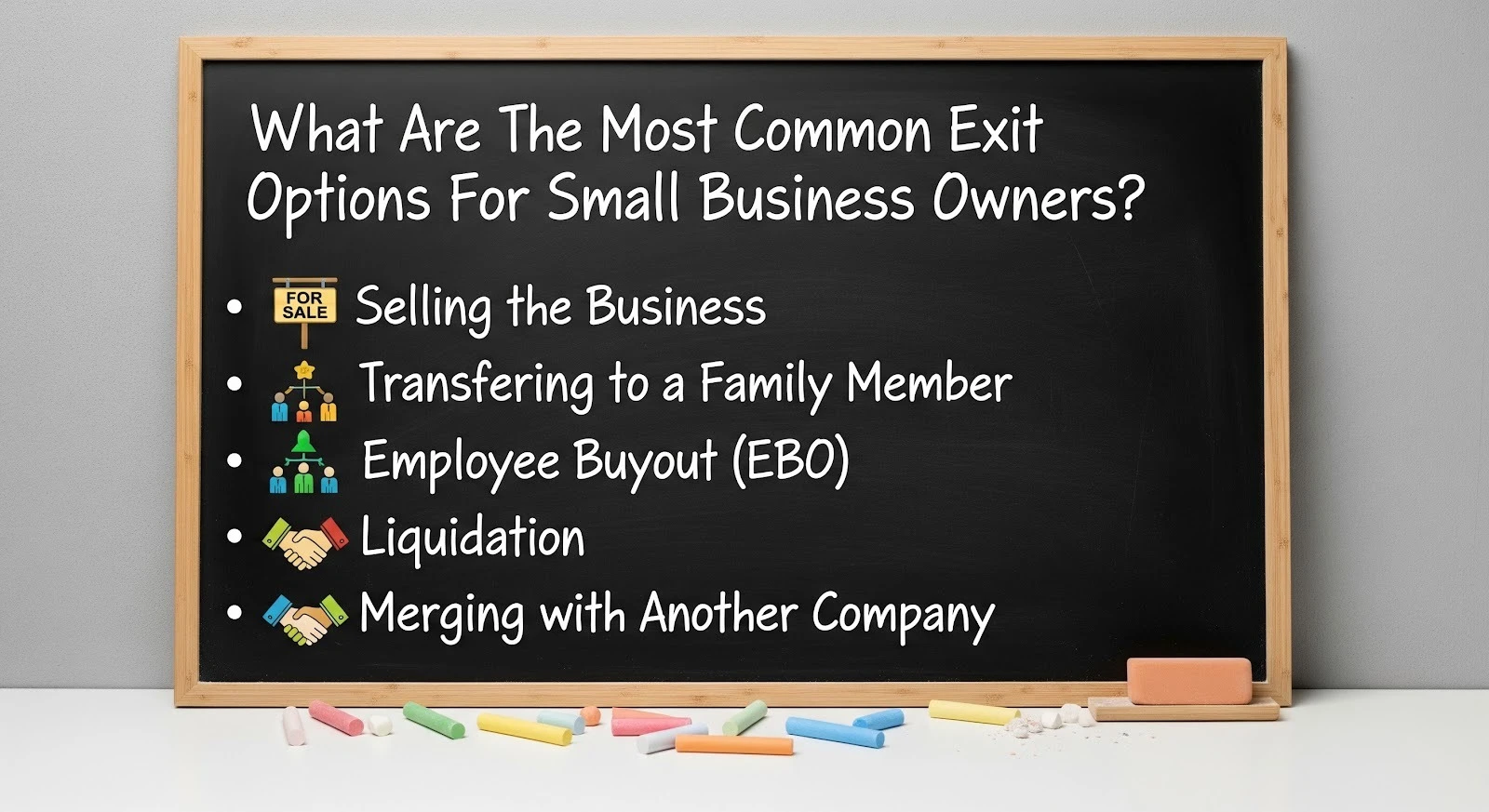

You need to stop hoping and start picking a lane. There are really only three ways out of this game. You need to choose one before the market chooses for you.

Selling Your Business to a Competitor

This is what everyone wants. You sell your company to a competitor or a bigger player in your industry. It sounds great. You get a clean break and a lump sum.

But getting there is brutal.

External buyers do not care about your legacy. They do not care that you sponsored the local footy team for ten years. They care about one thing. Transferable cash flow.

If the business relies on you being there every day, you have nothing to sell. I tried to broker a deal for a marketing agency a few years back. The numbers looked good on paper. But once the buyer dug in, they realized all the key client relationships lived in the owner’s head. The deal fell apart in forty-eight hours.

To pull this off, you need to make yourself useless. Your systems need to run without you. Your revenue needs to be recurring. If you can do that, you might get the payday. Just be ready for due diligence. It feels like a colonoscopy without the sedative.

Management Buyouts and Family Succession

Maybe you want to keep the culture alive. You want to pass the torch to your kids or your key managers. This is where Business succession planning usually gets messy.

The emotional appeal is high here. You know these people. You trust them. And you get to walk away feeling like the good guy who looked after his crew.

Here is the problem. They are broke.

Your managers might be great at their jobs, but they rarely have a spare million dollars sitting in their bank accounts. This means you become the bank. You sell them the business, and they pay you back out of the future profits. This is called vendor finance.

It is risky. I have seen owners retire, hand the keys to a manager, and watch the business tank six months later. When the profits stop, so do your payments. You end up un-retiring just to save your nest egg. If you go this route, you need ironclad agreements and a transition period that lasts years, not weeks.

Liquidation of Business Assets

Nobody invites me to dinner to talk about liquidation. It feels like failure. But sometimes it is the smartest move on the board.

If your business is highly specialized or relies entirely on your personal reputation, finding a buyer is like finding a needle in a haystack. Sometimes the assets are worth more than the company itself.

I knew an owner with a niche printing business. He spent two years trying to find a buyer. He paid brokers. And he stressed out. He wasted time he could have spent fishing. Eventually, he just sold the client list to a competitor for a small fee, auctioned the equipment, and shut down the lease.

He netted more cash doing that than the lowball offers he was getting for the whole company. It wasn’t the glorious exit he wanted. But it was fast. It was done.

How to Choose a Business Exit Strategy

So how do you decide?

You need to look at your numbers without your ego getting in the way. This is where most people fail. They look at their revenue and confuse it with value.

I swear by the “30% Rule.” It’s a rough metric, but it holds up. If you list your business on the open market, there is only about a 20% to 30% chance it actually sells. Those are terrible odds.

If you need the money to retire, you cannot gamble on a maybe.

You need a valuation that isn’t based on your gut feeling. I often tell clients to stop guessing and go talk to the pros who do this for a living. I know some Perth financial advisors who are absolutely ruthless when it comes to valuations. They don’t care about your feelings. They look at the P&L and tell you exactly what the market will pay. You need that kind of blunt honesty right now.

If the number they give you is lower than you need, you have work to do. You either grind for three more years to pump up the profit, or you lower your lifestyle expectations.

Start Planning Your Business Exit Today

The worst thing you can do is wait until you are burned out.

When you are desperate, you show fear. Buyers can sense it. They will lowball you because they know you just want the pain to stop.

Pick your exit now.

If it is a trade sale, start building systems today.

If it is an internal succession, start training your replacement tomorrow.

And If it is liquidation, stop reinvesting in new equipment you won’t use.

The business is not your baby. It is an asset. Treat it like one.

FAQs

The three main options are selling to a competitor, transferring ownership through management or family succession, or liquidating the business assets.

Because the business depends too heavily on the owner and lacks transferable systems, recurring revenue, or documented processes.

Predictable cash flow, strong systems that run without the owner, and client relationships that aren’t tied to one person.

No—while it can offer a clean break and lump sum, it only works if the business can operate independently of the owner.

It’s when key employees or managers purchase the business, often using vendor finance paid from future profits.

If the business underperforms after the transition, payments stop and the seller may be forced back into the business.

Only when successors are capable, properly trained, and supported by clear agreements and a long transition period.

No—liquidation can be the smartest option when assets are worth more than the business as a going concern.

On average, only about 20–30% of small businesses listed for sale actually close a deal.

Years before burnout sets in, while the owner still has leverage, energy, and time to improve value.